As P2P-Kredite.com reports the first 2 loans at German p2p lending service Smava.de have defaulted. Since the Start in March 2007 a loan volume of 1 million Euro (approx. 1.4 million US$) has been funded at Smava. The amounts of the two defaulted loans are 4,000 and 6,000 Euro resulting in a default rate of about 1%. At Smava loans default 40 days after they are late and are sold in a debt sale for a fixed rate of 25% (22% on lowest credit grades) to a collection agency.

2007 has been a very good year for Smava lenders as defaults (and late payments) have been significantly below expected rates.

Month: December 2007

Zopa Italy promises to lend at Kiva

In an email newsletter Zopa Italy encouraged its member to spread the word about Zopa to friends and relatives. Zopa says it is for 'a good reason': Zopa Italy pledges to lend $1 on Kiva for each new member that registers at Zopa Italy before January 15th.

Everybody can monitor how much Zopa invested on this lender page at Kiva.

I am sure that Kiva will highly appreciate this promotion, a target audience that is already interested in p2p lending gets introduced to Kiva's concept. But I am not sure if that is a good marketing campaign for Zopa. Should the lenders decide Kiva is an interesting concept they might lend their money at Kiva instead of at Zopa. Maybe Zopa speculates lenders will invest in both. Or Zopa wants the added social angle to increase chances of press coverage.

What do you think? Discuss this at the Zopa forum.

(Source: Email newsletter from Zopa Italy, Dec. 27th)

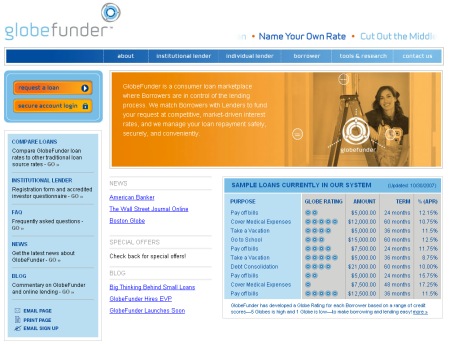

New Globefunder homepage

Today I noticed that Globefunder.com has a new homepage. While still pre-launch, it lists 28 states with licenses and limits, explains GlobeFunder's internal Globe Ratings (minimum required credit score is 640).

The fees page only lists fees payed by borrowers, with the main loan closing fee at 1.75 percent or $50 (whichever is greater).

While Globefunder is not open for registration yet, the new Wiseclerk's Globefunder forum is open for your discussion.

Read earlier articles on the Globefunder p2p lending service.

Review of peer to peer lending developments in 2007

2007 was an exciting and eventful year in the development of peer to peer lending. Looking back these were the highlights:

- February: Boober.nl launches the first p2p lending service in the Netherlands.

Prosper.com raises required borrower credit score to 520 and introduces other major changes - March: Smava.de launches German p2p lending service

- April: Fairrates.dk offers person to person lending in Denmark

- May: Lendingclub.com launch in the US, initially limited to Facebook members

- June: Prosper raises another 20M US$ VC. PPdai p2p lending launch in China

- July: Globefunder raises 1.5M US$ VC

- August: Boober is temporarily forced to stop lending by financial authorities. MyC4, which allows lenders to fund microloans to African entrepreneurs, grows steadily while still in private beta

- September: Kiva sold out after extensive media coverage.

- October: Microplace launches with microlending. Microplace is an Ebay company. Australia gets peer to peer lending through iGrin. Zopa UK launches 'Zopa Listings'. Prosper portfolio plans introduced. A Prosper SEC filing is the first step towards a secondary market for Prosper loans

- November: Boober and Zopa launch in Italy. Prosper reaches 100 million US$ loan volume.

- December: Zopa US launch. Lendingclub goes nationwide. Canadian Communitylend receives 2.5M VC. In Sweden Loanland is the first p2p lending service.

I will write another article on which trends to expect in p2p lending in 2008.

Half percent more interest at Lendingclub

Today for all new loans the interest rates at Lendingclub.com increase by 0.5 percent. At Lendingclub, unlike other p2p lending sites, the platform not the borrower sets the interest rate (based on credit grade). The increase was in reaction to rising borrower demand after Lendingclub eliminated state loan rate caps last week by going nationwide.

As a lender you can profit furthermore from two current promotions at Lendingclub. You get a 5% cash bonus if you lend 5,000 US$ or more by Feb. 3, 2008 (max. 20,000 per lender). Plus you get a 25 US$ signup bonus, if you sign up through this referral link.

Questions? Suggestions? Use the Lendingclub forum.

Kiva growth

Kiva.org send a newsletter to lenders yesterday with current numbers:

Kiva.org send a newsletter to lenders yesterday with current numbers:

- Over 16 million US$ in loans funded

- Average Kiva loan funds in 1.01 days

- More then 170,000 lenders

- 25,000 entrepreneurs received a loan

Kiva has grown a widespread group of supporters, ranging from Kiva Fellows over company supporters to a lively community discussing at Kiva Friends or contributing at Kivapedia.

KivaTV is showing a mix of promotional, educational and informational video clips.

Kiva still maintains a low default rate, which currently is 0.2%. The 20 Kiva loans I myself have invested in are all repaying on time.