A look back on the past 11 years, that saw the rise of numerous UK fintech players. How the financial crisis provided a hotbed for startups to foster and grow rapidly. The video by 11FS is an hour long and delivers and interesting recap. There is also a report.

Video

Videos on the p2p lending services

Crowdproperty Pitches to Raise 600K GBP through Equity Crowdfunding

![]() UK p2p lending marketplace Crowdproperty is currently pitching on Seedrs to raise 600K GBP from the crowd at a pre-money valuation of 5.9M GBP.

UK p2p lending marketplace Crowdproperty is currently pitching on Seedrs to raise 600K GBP from the crowd at a pre-money valuation of 5.9M GBP.

The Crowdproperty marketplace was launched in 2014 and the company has since funded 10.7 million GBP in property loans. All loans are secured by a first legal charge against the property. The company says no investor has incurred any losses so far. The company received full FCA authorization in October 2017.

Crowdproperty states it has unique proprietary access to the largest property network in the UK, the Property Investors Network (pin), which provides competitive advantage in terms of high quality deal origination and has enabled the proof of the business with limited marketing investment to date.

Crowdproperty claims that it’ is already profitable with more favourable economics than peer to peer platforms in consumer and SME marketplaces owing to shorter average loan lengths, higher average loan sizes, borrower frequency/retention and achievability/sustainability of fee levels. With a gulf now emerging between property-based peer to peer lenders that are gaining traction versus those struggling at the sub-£5m level, the team aims to become the market leader in project-based finance direct to SME property professionals whilst simultaneously providing competitive first-charge secured returns to its retail pool of lenders. ‘

CEO Simon Zutschi told P2P-Banking: ‘I am delighted that we have now proven this model of helping successful property developers to fund their projects, whilst helping investors gain a secured return on their money. All of the recent project launches have been quickly funded up by our eager and loyal base of lenders, which clearly demonstrates the traction we have built in our brand. Over the last year, we have focused on our platform technology and processes, and now we are ready to scale this business to its full potential. This will not only benefit our lenders, but also help and support SME developers, who often struggle to raise funds from hesitant banks, to access the essential funding they need to help reduce the UK housing crisis’.

(Source: Crowdproperty pitch on Seedrs)

Plum Automates Investment in Ratesetter – Plum Equity Crowdfunding Pitch

Plum is another fintech that makes use of Ratesetter’s products through a cooperation. Plum is bot on Facebook messenger designed to automate savings for the user and to invest money on his behalf. Savings can currently be invested in Ratesetters rolling market. Plum is currently pitching to raise 700K GBP through a convertible with a valuation cap of 5M GBP on Seedrs. Watch the video for more information on the Plum product and pitch. The minimum investment for this equity crowdfunding campaign is 10 GBP. The pitch is EIS eligible (UK residents). Other investors include 200K US$ invested by VC 500 Startups. This pitch is not yet officially launched on Seedrs, but already open for investments. You can use P2P-Banking’s free notification service to be alerted of upcoming Seedrs pitches early and review them ahead of the crowd.

Competitors of Plum include Digit, Qapital, Clarity, Albert, Squirrel, Cleo and Savedroid.

The Plum pitch deck is informative reading. To request that, login, click on ‘Documents’ in the pitch, and send a message to request the pitch deck.

Another example of an innovative cooperative cooperation making use of products of a p2p lending service is Commuterclub.

This article is not an investment advice. Investing in startups bears significant risks, including total loss of investment.

Friday Fun: Bondora’s Personalized Investment Video

Just before the weekend Bondora sent me an email with a personalized investment overview video (click here to see mine; I was not able to embed it directly here in the blog). The video page encourages sharing via social media (Google, Linkedin, Facebook, Twitter), so obviously an aim is to aid in investor marketing. In future I might need to spend less effort on my personal portfolio reviews and post the video instead (just kidding). The highlighted return figure is higher than my own calculations, but I did achieve a high return on Bondora over the past years.

Have you seen other attempts on viral marketing via investors by p2p lending marketplaces? Let me know in the comments, please.

EDIT: Succeeded in embedding the video now:

A Look At My Current Bondora Portfolio

In October 2012 I started to invest into p2p lending at Bondora. I periodically blog about my experiences – you can read my update from Dec. 2015 here. Over the total time I did deposit 14,000 Euro and withdrew 13,380 Euro. So as you see I cashed out an amount almost equal to the amounts I deposited. The good news is that I still own 705 loan parts with an outstanding principal of 10,362 Euro at an average interest rate of 23.74%. Of these 6,355 Euro are in current loans, 1,004 Euro in overdue loans and 3,003 Euro in 60+ days overdue loans. The reason that I still have such a large loan book despite cashing out nearly as much as I paid in, is that I reinvested nearly all interest and principal repayments from 2012 till 2015.

Bondora shows a net return of 24.6% for my portfolio. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 17.0% return.

Let’s look how my remaining portfolio is distributed by several criteria

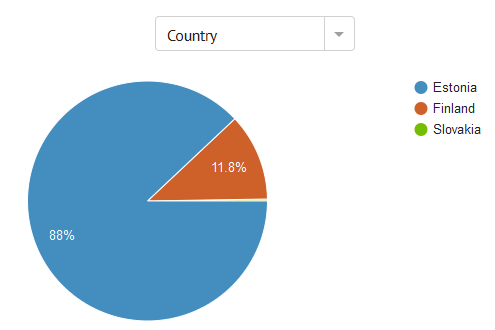

Chart 1: My portfolio by country

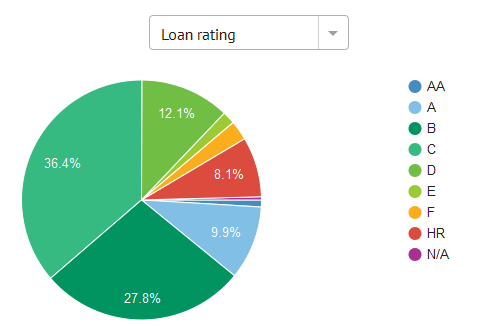

Chart 2: My portfolio by rating

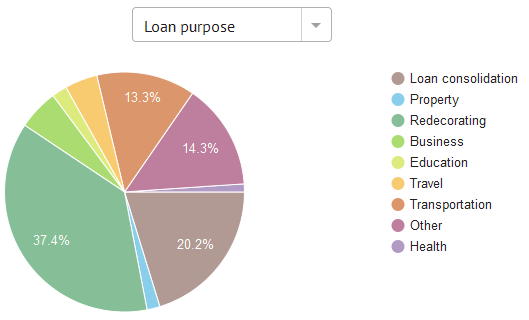

Chart 3: My portfolio by loan purpose

Recent developments

A lot has changed in the past four months. With the introduction of new regulation in Estonia, Bondora now prefunds all loans and also keeps a stake in the loans (‘skin in the game‘). Manual bidding on loans is not as straightforward as previously because now investors can make bids, which are not binding until allocation happens. This leads to situations were say 155% of the loan amount has been bid for, but the allocation has not happened yet, because some of the bidding investors have not enough cash in their account to match their bids and those bids that are sufficiently funded don’t add up to 100%. Furthermore Bondora gives bid preference to bids with larger amounts. If at allocation time bids with enough cash add up to more than 100%, then the bids for higher amounts will succeed, while the smaller amount bids will be rejected.

Live Stream of the P2P lending Conference in Vilnius presented by Savy*

The first P2P lending platform in Lithuania, SAVY, is organizing their second annual P2P lending conference on the 23rd of March in Vilnius, Lithuania. Guest speakers from all over the world, including the co-founder of LendIt Conference Jason Jones and the leaders of the top Baltic P2P lending companies – Mintos, Bondora and SAVY, amongst others, will engage in a number of panel discussions and presentations.

The conference will be focused on the possibilities of P2P lending and Crowdfunding, while the participants will touch some important topics related to the prospects, challenges and trends for Alternative Financing on a global scale and in the Baltic region specifically, as it offers a considerably higher return on investments than most Western European countries.

https://www.youtube.com/watch?v=B29ozFU0CQE

Live stream of conference starting at 13:30 GMT+2 on March, 23rd

*Sponsored post: This post was paid for by Savy.lt, the conference organizer. I rarely publish sponsored posts, but in this case I thought the content is a very interesting fit for the blog audience.