![]() When Prosper.com went in the quiet period the company announced on its blog:

When Prosper.com went in the quiet period the company announced on its blog:

If you’re a borrower seeking a loan, you will still be able to create a new loan listing, which we will endeavor to fulfill through alternative sources.

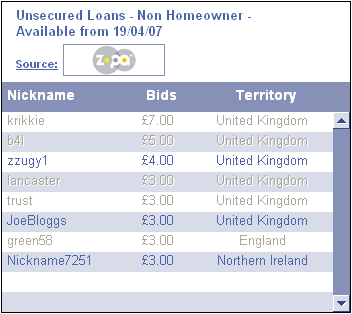

The way this works is that Prosper refers loan applicants to other lending companies. After answering a few questions, borrowers seeking a loan a channeled to Firstagain, Lendingtree, Freedomfinancialnetwork or Creditkarma (and potentially others – the mentioned ones are the ones I was shown).

Should a borrower use the services of one of the linked companies then Prosper is paid a referral fee.

However apparently not all visitors of the site seem to be redirected. Potentially members or former users with cookies are not shown these options.

Options shown for potential borrowers