Last year in September I signed up at UK platform Bondmason in order to test first-hand how an investment of 1,000 GBP would develop. As described in the review article, I wrote when I started, Bondmason is an aggregator that automates the investment across many p2p lending platforms for the investor and takes a fee for that. Bondmason projected a target return of 7% after fees and bad debt.

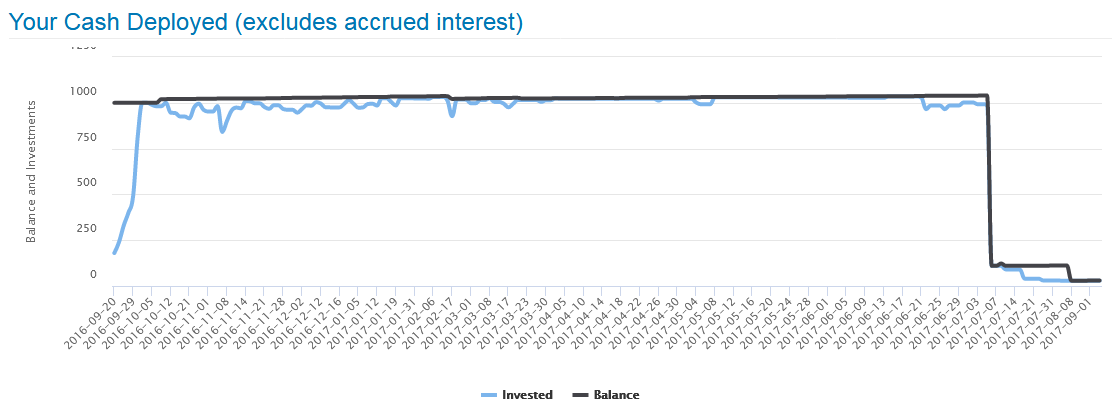

Allocation of my deposited funds into loans went okay. There was some cash drag, but not as much as other investors have experienced.

Deployment speed of my investment on Bondmason – click for larger image

What was bad, was that it became clear to me, that the interest level in combination with the non-performing loans would make it very unlikely for Bondmason to reach the projected return – at least for my portfolio. Especially with the Invoice Discounting loans there were issues.

In April 2017 Bondmason announced it would require a larger minimum investment amount of 5K (previously 1K) and raise fees for small portfolios to 1.5% (previously 1%). Dang. I was in no way interested to deposit more money. So my portfolio did not even get to celebrate 1st anniversary. In July I gave them notice to liquidate my portfolio/account. Since then I withdrew 1,013.94 GBP – only slightly more than I deposited. My account still exists as there is 20 GBP stuck in two property loans in default and also 1.41 GBP in cash.

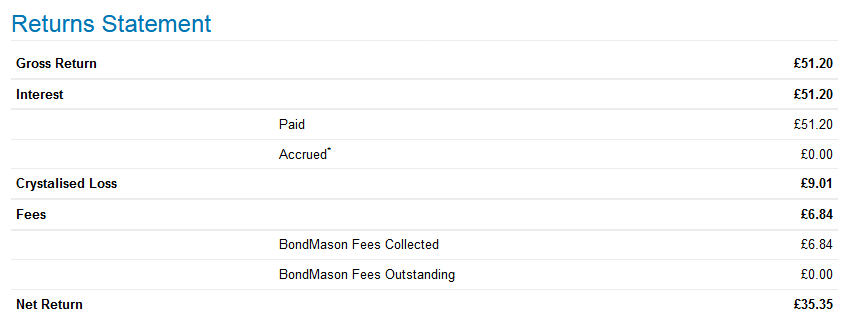

My Bondmason result (1) – click for larger image

My Bondmason result (2) – click to enlarge

Regardless of which way I look at it, the result is clearly bad. Obviously Bondmason by far missed the targeted return of 7% in my case.

If I take an optimistic view and just assume, my 2 defaulted loans would recover today and the outstanding amount is paid to me, then my self-calculated yield (XIRR function) would be 4.3%. If I need to write off the 2 loans in default then my self-calculated yield is 1.9%. And that is before tax – as a German resident I cannot offset bad debt against interest earned for tax purposes. And on top of that the pound has been detoriating against the Euro value in the past 12 months (not Bondmason’s fault).

So to sum up: I liked the idea of an aggregator and the Bondmason setup allows passive investing in a diversified mix of p2p loans. But my returns are among the worst I ever experienced on p2p lending platforms and I am certainly happy I conducted this test with 1,000 GBP only and did not risk more.

If you want more details about the development of my portfolio throughout the past year there are more snapshots with screenshots over time in this thread.

My experience is identical to yours. Bondmason made a derogatory comment towards other P2P Platforms regarding performance, professionalism, integrity, etc – or a lack of. So in effect they became a self appointed ‘guru’ for P2P lenders/investors. My experience however is they are extremely naive themselves.

I do not object to paying fees for their services but in return I expect them to perform close to or exceed their targeted return. I’ve withdrawn and my XIRR shows a return of 3.93% after a 9 month trial.

@wiseclerk – thank you for your detailed comments and for giving BondMason a trial.

There is a range in the returns across clients, which is a combination of:

– the range of initial allocation speeds;

– whether a client has a 1% or 2% investment diversification setting;

– the range of the rates in each loan (although this isn’t so great); and

– whether a client has been unlucky in achieving more than the average crystallised loss rate (the average is 0.4%).

We would like for everyone to get the same return, but we are unable to structure our operations as a fund which would enable this – as there are liquidity, cost leakage and other issues with having clients come into a fund.

Nonetheless we are working at getting everyone closer to the average return – which is 6.5-7% after fees; 8% gross – for those that have been with us for a minimum of 12 months.

@ukinvestor – we stand by our comments in relation to the operations of a number P2P lending platforms that we have visited and reviewed. Although we don’t publicly state which platforms we are referring to; recent press (and undoubtedly more press over the course of this year) are illustrating this point for us.

There are still a good few operators that are doing very good things; but there are also others which you should be cautious of.

Our service is set to enable clients to achieve an attractive return, with a bias towards low volatility and capital preservation (although capital is at risk).

In some ways it is pleasing to note that the worst performers on BondMason have all made a positive return; and also better than any analogous offering – e.g. Ratesetter. But I understand your frustration that your return hasn’t been as high as many other clients.

I would be interested to know what was meant by “Especially with the Invoice Discounting loans there were issues.” The article seems to suggest it may have been bad debt related? However the level of bad debts in the sector seem to be at an all time low at present.

how does a non resident investor pay taxes on interest in UK ? i have read there’s a personal allowance of 1,000 GBP tax exempt but is a tax declaration still necessary ?

Usually p2p lending investors are taxed in the country of their residency, not the country of the marketplace. There are a few exceptions where tax is withheld, but usually not in the UK. Check with a qualified tax advisor for your circumstances.