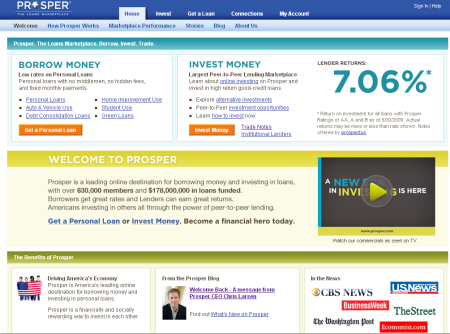

Prosper.com has reopened – now with the long sought approval of the SEC which was granted last Friday. In his blog statement “We mean it this time!” CEO Chris Larsen sheds light on what was delaying SEC approval. It was auction bidding on loan requests:

Prosper.com has reopened – now with the long sought approval of the SEC which was granted last Friday. In his blog statement “We mean it this time!” CEO Chris Larsen sheds light on what was delaying SEC approval. It was auction bidding on loan requests:

… the first Internet auction-based P2P loans marketplace and trading platform to have its SEC registration declared effective, which means the SEC is permitting Prosper to facilitate auctions in a way that has never been done before.

Selling securities by auction is not new and critical to greater efficiency in fair price discovery for both sides of the transaction. However, the SEC has never permitted Wall Street investment banks or any other institution to run a true auction where investors could make an irrevocable bid that committed funds prior to the establishment of a final rate….

Prosper introduces a secondary market. The internet auction priced trading platform for Prosper Notes is operated by FolioFN (like Lending Club’s Note Trading platform). Only loans (‘notes’) issued after July 13th can be traded.

At the moment lenders from California, Colorado, Delaware, Georgia, Illinois, Minnesota, Montana, Nevada, New York, South Carolina, South Dakota, Utah, Wisconsin and Wyoming can use Prosper, if they fulfill state set financial suitability requirements. Prosper is open to borrowers from almost all states.

With the PR Prosper will likely build up a large selection of loan listings again fast (as of now there are 10). The interesting question will be if Prosper lenders will continue to have faith investing via Prosper after extremely high default rates and low collection results in the past. Furthermore disappointed (former) long term lenders are critisizing risks for lenders embedded in the latest SEC filing.

With the likely press coverage of the relaunch all p2p lending companies in the US can expect to see a rise in traffic.

Comments are closed.