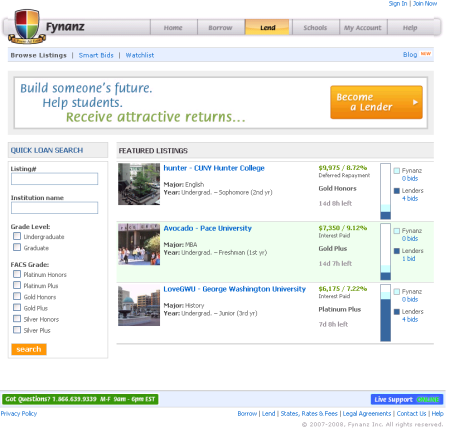

Fynanz.com, currently launching for borrowers in New York and Florida, offers peer to peer lending to students.

The service differs from other p2p lending service in many points.

- The private student loans, also known as "alternative student loans", Fynanz offers have variable interest rates. Other p2p lending services so far operate only with fixed interest rates. At Fynanz interest rates are based on the LIBOR index, adjusted quarterly, plus a margin which is set by lenders. Suggested margins are 3 to 7.5% for a typical overall interest rate of 6 to 11% before fees.

This is higher then federal student loans, but Fynanz still sees a large market, since federal student loans have borrowing limits and may not cover the entire costs of education. - Very long loan terms of 10 to 20 years. Again unsual, but lenders may offer to sell loans after one year at a discount to Fynanz. There also seems to be the option to transfer a loan to a different lender (allowing the sale to a different lender).

- Students can select to defer interest payments while in school and for a 6 month grace period after leaving school.

- Loan amounts range from 2,500 to 20,000 US$ per loans. Borrowers may take out up to four loans per year to a total maximum of 160,000 US$. That is an unprecedented amount in p2p lending.

- The fees are pretty high in my opinion. Borrowers pay 2.9, 4.9 or 6.9% (depending on FACS) of the loan amount origination fee. Addionaly borrowers pay 1% guarantee fee into the guarantee fund until they have repaid 10% of the loan amount. Lenders pay a 1% servicing fee (not while loan is in deferment)

- Guarantee for lenders. Not only in case of identity theft, but also in cases of defaults Fynanz protects 50 to 100% (depending on FACS grade) of the loan amount.

- Fynanz applies it's own FACS grade (Fynanz Academic Credit Score) to rate borrowers. It not only relies on the credit history but also on academic charateristics.

- Pledge bids allow lenders to bid without having funds in account. Lenders must transfer money within 5 days of bidding.

- Fynanz has a "bid priority" that ranks four types of types of lenders in the following order: the highest priority lenders are friends and family of the borrower; then alumni of the borrower’s school; third are unaffiliated lenders; and fourth is Fynanz itself.

Hollowoak has some more interesting points from the lender agreement in his blog, which Chirag Chaman, Fynanz CEO commented on.

To browse listings go to the Fynanz listings page.

Further information ressources include Tom's review, the comprehensive FAQ and the new Fynanz blog answering questions.

Overall it will be interesting to see how Fynanz develops. If you use Fynanz as a lender or borrower please share you experiences in the forum.