Wow, 5 years have passed since I first started to invest into p2p lending at Bondora in October 2012. I periodically review my experiences in this blog – you can read my last update here. Over the total time I did deposit 14,000 Euro and withdrew 17,800 Euro. So over time I withdrew more than I ever deposited, meaning 3,800 Euro realized profit. Even better: I still have 604 loans in my Bondora portfolio with an outstanding principal of 7,467 Euro at an average interest rate of 23.78%. Of these 2,746 Euro are in current loans, 778 Euro in overdue loans and 3,941 Euro in 60+ days overdue loans. Some of this very overdue loans do in fact make very regular monthly payments, albeit smaller than the planned payments in the original payment schedule – it will take much longer for the loan to be repaid. And of course many of my red loans are duds, which haven’t made a single repayment and it is unlikely any recovery will be achieved. There is 43 Euro cash in the account.

Bondora shows a net return of 19.0% for my portfolio. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 17.2% return. Even if I assume total loss on all outstanding loans that are 60+days overdue my ROI calculation results in 15.6%

Let’s look how my remaining portfolio is distributed by several criteria

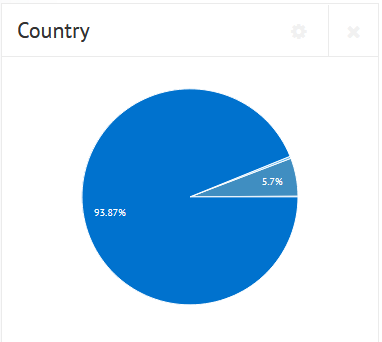

Chart 1: My portfolio by country; majority in Estonian loans, remainder in Finnish loans

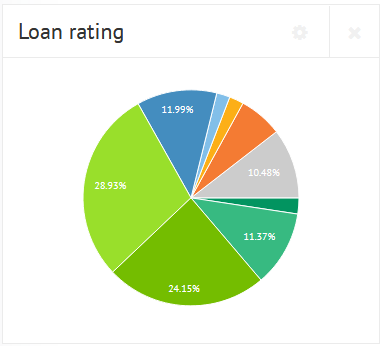

Chart 2: My portfolio by rating: more than half of the amount in B and C rated loans, large portions also in A and D ratings

Current situation at Bondora

New investors cannot expect to achieve similar yields. Interest rates are much lower now than when I started and I achieved a portion of my profit by trading loans on the secondary market at premium.

If you want to start on the Bondora p2p lending marketplace now, consider using the Portfolio Pro autoinvest set to Estonian loans only with AA to B (or C) credit grades. Maybe try some Finnish loans with better credit grades too.

Bondora originates roughly 3 million Euro new loans per month. There is no cash drag, usually available amounts get invested very fast.

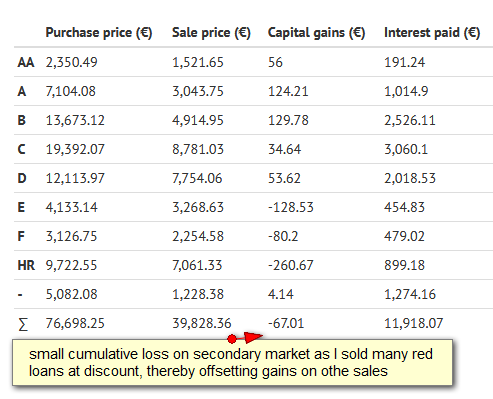

Chart 3: Cumulative all time development of my portfolio by credit grades 2012-2017. Remember I only deposited 14,000 Euro. The high 76,698 Euro given as total investment is a result of reinvestments and active buying and selling of loans.

hi,

Thanks for sharing!

But hmmm, if you started with 14,000 and after 5 years you have 17,800

than you have a cumulative interest of 4,9%

$14000 * 1,049 * 1,049 * 1,049 * 1,049 * 1,049 * = $17,800

for the kind of risk with Bondora that does not seem great.

Obv. it depends when you added that 14,000

Hi Bjorn,

You are totally omitting the 7,467 Euro still invested in loans that are currently in my portfolio (and the 43 Euro cash). Depending on assumptions the ROI is therefore 17.2% or 15.6% in a pessimistic scenario (see above).

hi Wiseclerk,

Ok let me see if i get your numbers…

you started 5 years ago with 14,000 Euro and withdrew 17,800

further you still have:

2,746 Euro are in current loans,

778 Euro in overdue loans and

3,941 Euro in 60+ days overdue loans

So in best case scenario (unlikely) you have (everything added up above) euro 25,265

that would give you a 12,5%/year which sure is very nice

14,000 * 1,125 *1,125 *1,125 *1,125 *1,125 = 25,265

If we write off the 60+ days loans, you get euro 21,324, that is:

8,78% / year

14000 * 1,0878* 1,0878* 1,0878* 1,0878* 1,0878 = 21,324

I don’t see your 15,6% or 17,2%, how do you calculate that?

For money you don’t need to eat, it still is a nice return, but for comparison reason the SPY did (on average) 12,5% every year in past 10 years…

i like P2P myself too but wonder what would happen in a 2008 scenario, you would still have your SPY (although with big loss) but i guess P2P loans will be gone…

i think sharing via blogs as these is great, looking forward to your next financial adventures!

Hi Bjorn,

>I don’t see your 15,6% or 17,2%, how do you calculate that?

I use XIRR.

Your estimate assumes the payout would be now. The difference to my calculation is that I withdrew more than 13000 a longer time ago (so the money earned the profit in a much shorter investment period).

I don’t see investing in p2p lending as superior over investing on the stock market but rather as a diversification into a different asset class.

hi Wiseclerk,

Ok if you took money out sooner than that makes sense…

Apart from p2p what other assets/investments do you have?

What was the best investment ever? for me I guess my company…

regards,

bjorn