A few weeks ago I decided to start a small test portfolio investing in p2p loans at Zlty Melon. Zlty Melon is a p2p lending marketplace in Bratislava, Slovakia (see earlier articles about the Slovakian market). The marketplace lists loans to borrowers in Slovakia in Euro currency and to Czech borrowers in CZK. On the investor side Zlty Melon is open to residents of the European Economic Area. The website is available in English, Czech and Slovak languages.

I deposited 400 Euro via SEPA transfer. If you need currency conversion during a deposit, it might be cheaper to use Transferwise or Currencyfair than to do a direct bank transfer. Zlty Melon offers a range of loan types from unsecured consumer loans to ‘cashfree housing loans’ which the site describes as follows: ‘Loan to finance a new housing purchase. This loan is provided in cooperation with a well-known developer and is used to cover part of the purchase price of the property bought by the applicant. The real estate is being under construction.’.

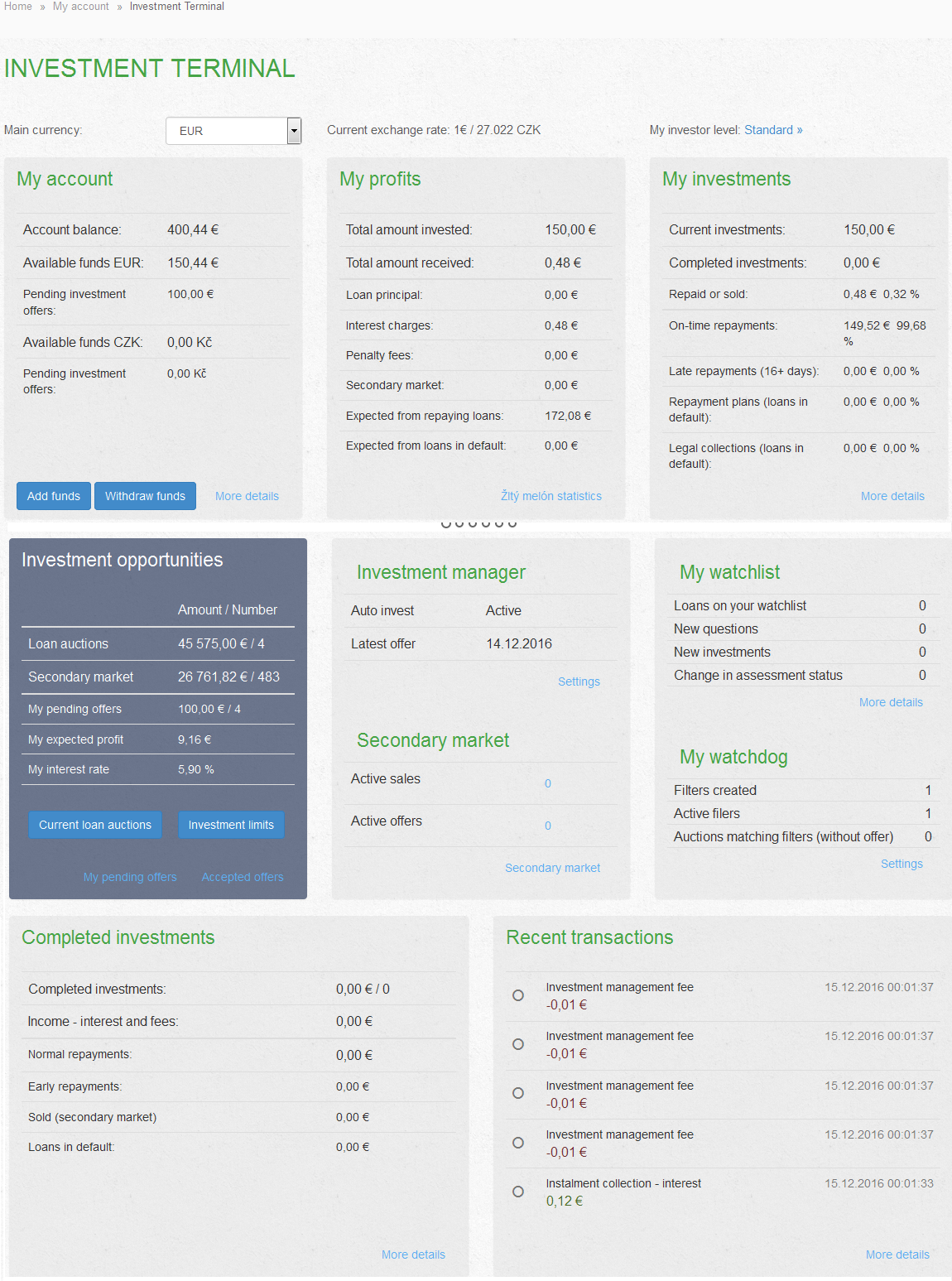

I set up an autoinvest (called ‘Investment Manager’) to automatically bid 25 Euro on each new cashfree housing loans, as these seem the most secure loans and so far according to Zlty Melon’s statistics for this loan type there have not been any defaults. I set it up to invest in Slovak loans only as I didn’t want any currency risk. Maturity periods range from 1 to 5 years. For this loan type the interest rate is 5.9% p.a. and Zlty melon charges investors a fee of 0.33% on all installment payments. EDIT: Currently Zlty Melon runs a promotion for investors – if a large amount is invested in a single cashfree loan then investors can earn up to 1.1% bonus interest, making the total interest rate up to 7.0%. For unsecured consumer loans (which are graded AA to D- & HR) interest rates are much higher – up to 30-40% for HR loans – and the fee is 1%. Investors there engage in auction bidding against each other.

Screenshot: Excerpt of my Zltymelon dashboard

As I started only a few weeks ago, I don’t have that much experiences to share, only that the website is easy to use and offers a lot of information. With my selection criteria there is quite a bit of cash drag, as there are not that many new loans that match my filters. The total new loan volume (all loan types) that Zlty Melon originates each month is about 0.2 million EUR. Zlty Melon has a good comprehensive statistic page.

Zlty Melon does have a secondary market, but I have not used it.

While the interest rates on the loans I invest in are rather low, I like that the possibility to invest into Euro based p2p loans in a marketplace outside the Baltic area for diversification. I will see how my test portfolio develops and report on it periodically.

Average interest rates and impact of defaults so far (excerpt from the statistic page)

Slovensky – Cesky poskytovatel kolektivnych poziciek Zlty melon vymenoval noveho sefa pre oblast riadenia rizika a oznamil partnerstvo so spolocnostou Lucron Development