In October 2012 I started to invest into p2p lending at Bondora. I periodically blog about my experiences – you can read my update from Dec. 2015 here. Over the total time I did deposit 14,000 Euro and withdrew 13,380 Euro. So as you see I cashed out an amount almost equal to the amounts I deposited. The good news is that I still own 705 loan parts with an outstanding principal of 10,362 Euro at an average interest rate of 23.74%. Of these 6,355 Euro are in current loans, 1,004 Euro in overdue loans and 3,003 Euro in 60+ days overdue loans. The reason that I still have such a large loan book despite cashing out nearly as much as I paid in, is that I reinvested nearly all interest and principal repayments from 2012 till 2015.

Bondora shows a net return of 24.6% for my portfolio. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 17.0% return.

Let’s look how my remaining portfolio is distributed by several criteria

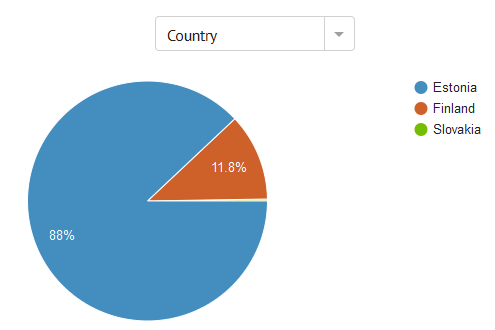

Chart 1: My portfolio by country

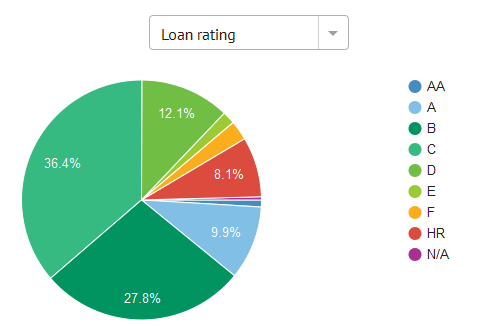

Chart 2: My portfolio by rating

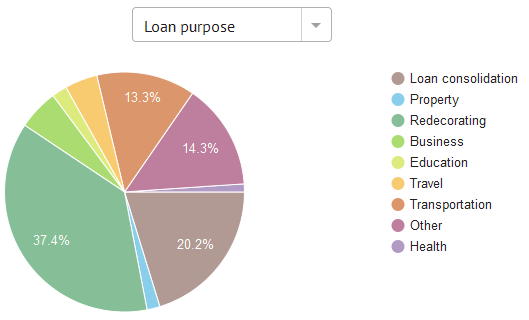

Chart 3: My portfolio by loan purpose

Recent developments

A lot has changed in the past four months. With the introduction of new regulation in Estonia, Bondora now prefunds all loans and also keeps a stake in the loans (‘skin in the game‘). Manual bidding on loans is not as straightforward as previously because now investors can make bids, which are not binding until allocation happens. This leads to situations were say 155% of the loan amount has been bid for, but the allocation has not happened yet, because some of the bidding investors have not enough cash in their account to match their bids and those bids that are sufficiently funded don’t add up to 100%. Furthermore Bondora gives bid preference to bids with larger amounts. If at allocation time bids with enough cash add up to more than 100%, then the bids for higher amounts will succeed, while the smaller amount bids will be rejected.

Bondora video explaining the new bidding system

Bondora also changed the collection process with the DCAs and the charges those DCAs levy. Read Kristi’s thoughts on this. Oktaeder is more critical on the changes (in German language).

Hi,

i like it and very good job. What is your average monthly income now? (cashflow)

Thank you and have nice weekend.

Hello Wiseclerk,

if I Can ask, how much do you receive in interests monthly having around 10k in your account. I receive around 1.3% of my balance.

Regards