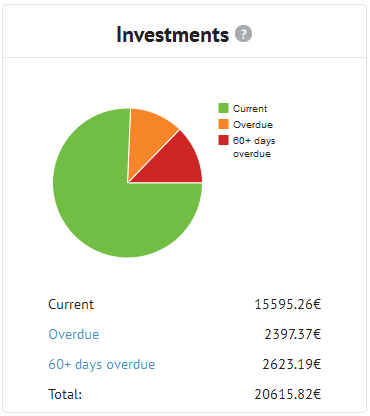

In October 2012 I started p2p lending at Bondora. Since then I periodically wrote on my experiences – you can read my last review here. Since the start I did deposit 14,000 Euro (approx. 15,600 US$). My portfolio is very diversified. Most loan parts I hold are for loan terms between 36 and 60 months. Together the loans add up to 20,616 Euro outstanding principal. Loans in the value of 2,397 Euro are overdue, meaning they (partly) missed one or two repayments. 2,623 Euro principal is stuck in loans that are more than 60 days late. I already received 13,261 Euro in repaid principal back – this figures includes loans Bondora cancelled before payout. I reinvested all repayments.

Chart 1: Screenshot of loan status

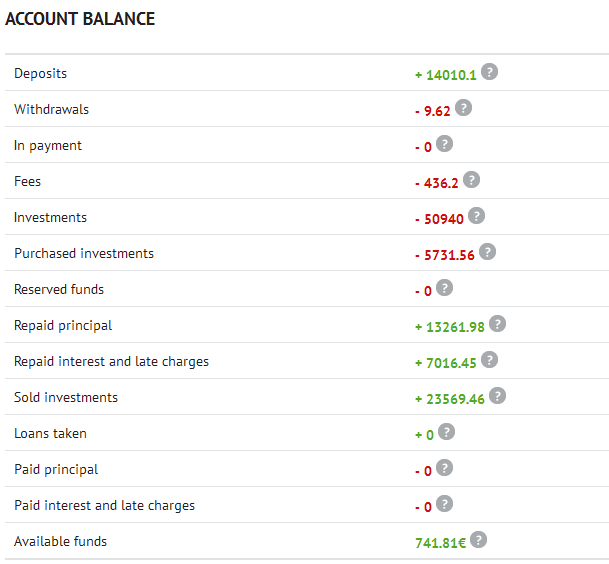

At the moment I have 0 Euro in bids in open market listings and 741 Euro cash available, which is rather high but it will take only 2 to 3 loans that match my investment criteria to allocate the money.

Chart 2: Screenshot of account balance

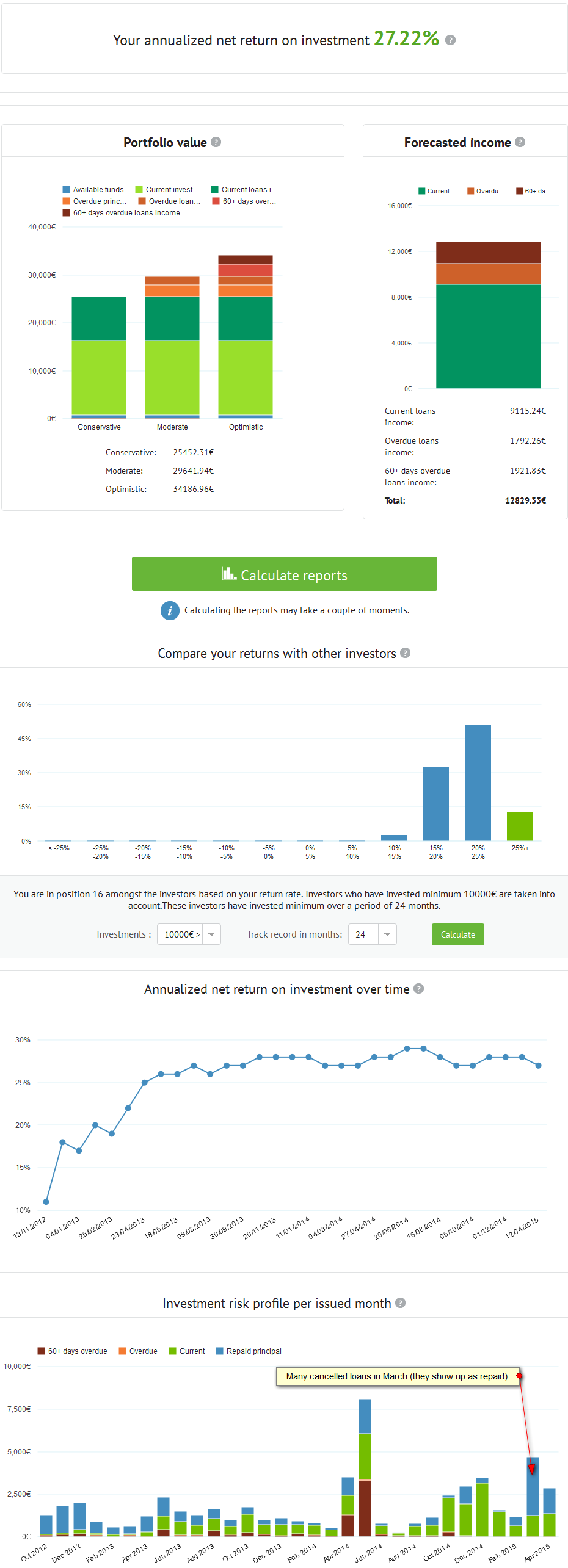

Return on Invest

Currently Isepankur shows my ROI to be 27.22%. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 19.6%.

Loan selection criteria – what I am currently bidding on

I select my loans manually currently. To compensate for the time needed to pick loans, I often make multiple bids totaling up to 300 Euro in one loan. Each bid is typically only 15 Euro to make it easier, should I decide to sell loan parts later on on the resale market.

My standard criteria for selection right now are:

- Bondora Rating AA to B, sometimes also C

- Credit Group A

- Credit History 1000

- Estonian loans only

- Age typcially from 25 to about 60

- Income ideally well above 1.000 Euro

- Income verified preferred

- Homeownership ideally Owner, Mortgage or Joint ownership

- one or more previous Bondora loans, where the borrower has made repayments for a couple of months are a plus in my view

- DTI that is not excessive

The way I do it, is to run this filter one or two times a day, which typically shows about 5 to 10 open listings and then I manually look at the loan details of each of these.

I don’t buy loans on the secondary market. While other investors point out that there are lots of good loan opportunities on the secondary market – and they are probably right – I find it to time consuming to monitor and bid on the secondary market. I would look into this again, if there was a way to automate selection and bidding on the secondary market for me.

How is your Bondora investment going? Share your actions and reasoning in the forum.

Chart 3: Statistics on ROI and funded volume for my account

I see that most of your defaults are from Apl/May 2014, when like me you added extra money as there were more loans available.

Unfortunately we now know that the quality of those loans was very poor and I am surprised to see that you only expect a 30% loss from your defaulted loans. There do not seem to be many payments being made for defaulted loans from then, many of which made no payments and there seems to be no evidence to support optimism regarding recoveries.

James,

thanks for your comments.

Regarding Apr./May 2014. As you are refering to the chart, I am pretty sure that this includes loans I no longer hold but rather sold off on the secondary market. The majority of loans I acquired during that time sold fast at premium.

I described what was going on at that time in this article:

https://www.p2p-banking.com/countries/baltic-review-of-my-current-bondora-portfolio-first-experiences-in-trading-bondora-loans/

As more than 85% of outstanding prinicpal in my account is in Estonian loans, I am pretty confident that recovery rates will be okay. It just takes time. But even assuming 100% loss on 60+ overdue loans I would still have a 13.7% ROI at the moment by my XIRR calculations.

Everybody should calculate with the assumptions he feels confident. I am in no way stating that calculating with a 30% loss rate is the “right” way to do it. It is just the way I personally do it at the moment to keep track how my portfolio develops.

Ah yes, I had forgotten that the Bondora statistics only show loans you originally made bids for and do not show your current portfolio, unless like me you do not normally use the secondary market. In my case the red and green areas for last April/May are of similar size and show a true picture of the quality of loans which I took on then and still hold. Needless to say I changed my loan choices as soon as that became apparent and my loans made since last August have so far been performing much better.

Hi!

Thanks for sharing.

Based on what you explained your investment strategy is quite conservative (especially comparing with Conservative Portfolio Manager of Bondora :-)). At the same time if to have raw calculation looking at your total investments then current 60+ days overdue it is around 10%. While based on the latest Bondora statistics it should be at least twice less, around 4%. Do you have an explanation of it? What is your view on the numbers Bondora publishes about overdue and defaults and real life?

Thanks.

HI Dmitry, I’ve been lending since Oct. 2012 and my strategy (and Bondora) changed over time. Read the old posts to see what I invested in earlier. Only consistent point is that at all times I concentrated on Estonian loans. I have invested in some Finnish loans and a few Spanish and Slovakian loans to gain experiences, but only small amounts. Best of success for your investments

Thanks for the insight, Claus! Always good to read real numbers.

I was wondering is there any specific reason that you haven’t added extra capital lately to Bondora?