One important aspect for p2p lending investors is tax. In this blog whenever I talked about yields achieved, it is usually pre-tax yield. That is because taxation varies significantly from country to country. In most cases the place of residency of the investor determines the tax regime applicable. There are a few exceptions, e.g. on very few marketplaces withholding taxes are applied.

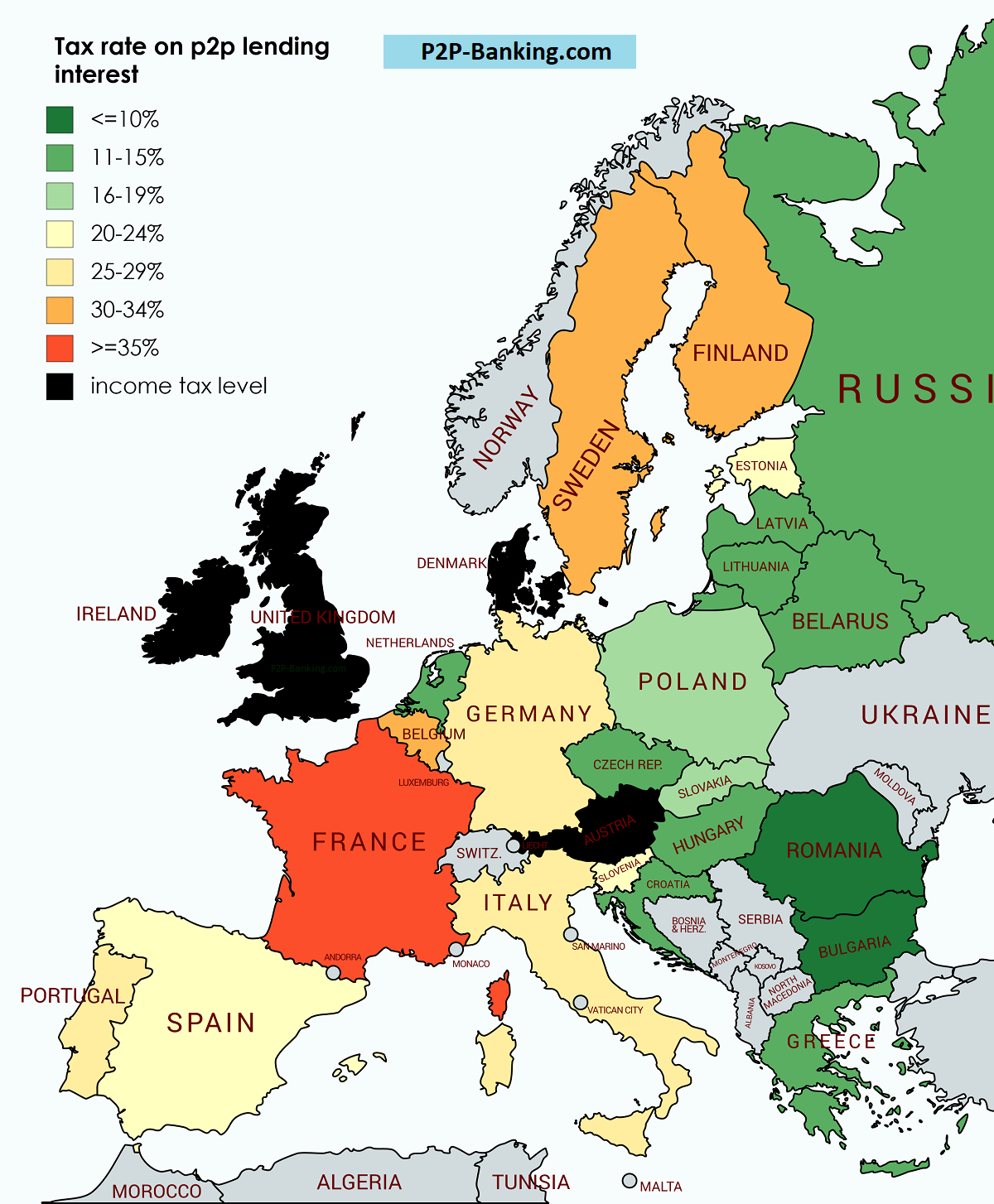

But I wanted to give a viusal overview on how different tax rates are for p2p lending investors, depending on where they live in Europe. Therefore I created for following map.

For overview purposes only. Source: own research – may contain errors or be outdated. Please note that this is a simplification and will not cover many cases. Do not make any decisions based on this, but rather consult a qualified tax advisor

In the countries colored in black the income tax rate is applied on interest earned on p2p lending investments. That means the individual rate of taxation depends on the other and overall income of the investor. For example in the UK the tax bands are 20%, 40% and 45% dependent on overall income. In Ireland tax bands are 20% and 40%.

If you live in Latvia and invest on Mintos, the Latvian tax department might consider you a self-employed trader (23% tax rate) rather than a private investor.

But in most other countries there is a fixed rate applicable for interest earned on p2p lending. Tax free allowance up to a certain amount may apply. For example in Germany taxation (Kapitalertragssteuer)Â is 26.375% (a little higher if church tax applies).

Taxation is complex. Futher important points are whether defaults and fees can be offseted against interests earned. Also capital gains (e.g. from selling loans with a premium on a secondary market) may be taxed different than income.

Advantageous tax rules

There are many special tax rules and tax breaks. Consult a qualified tax advisor for information on your situation. Here are just some interesting examples.

UK: UK residents can invest through so called ISA products. There is a special IFISA (Innovate Finance ISA) which can be used to invest up to 20,000 GBP tax-free on peer to peer marketplaces. More information and an IFISA comparison is here. The interesting point is that the allowance is available per year. That means an investor using it in 10 consecutive years can invest 200,000 GBP tax-free into p2p lending.

Estonia: Many Estonians lend through a limited company (OÜ) they have set up. The advantage there is , that as long as the earnings stay in the company they are not taxed. Only at the time the profits are paid out from the company to the investor they are taxed at 20%. This allows investors to postpone the taxation for a long time.

Netherlands: The Netherlands are the only country in Europe where the tax is not based on actual p2p lending earnings, but rather fictual earnings. Wait. What? The tax system is actually a wealth tax, and the tax declaration is not based on income but wealth. The tax authority then assumes you earned a fictual income of 4% on your wealth. Tax rates used to be 30% on that (so 1.2% on your wealth; since 2017 it is now 0.581 to 1.68% dependant on amount of wealth). Now if you actually earned 10% ROI with your p2p lending your effective tax rate calculated on that would be 12% (30%*4%/10%). That’s what I used for simplification purposes in the map.

Portugal: In Portugal the rate is 28%. But if a foreign resident moves to Portugal and earns interest only from p2p lending market places abroad, he can profit from a 0% tax rate on these (providing the originating country does not tax the interest) for 10 years. Mark explains his personal experiences with this on obviousinvestor.com. There are non-resident/non-domiciled rules in other Euopean countries but they usually sound more complicated/restrictive.

Hint to platforms: It may be efficient to target countries in your marketing that have a high GDP but also a low or medium tax rate on p2p earnings.

This article does not provide tax advice

As losses are not allowable against interest received in Ireland, (see Revenue Commissioners guidelines), the tax rate could exceed 100%, if losses exceed more than 50% of the gross interest.

For example a person has €100,000 invested across a range of P2P sites and receives gross interest of €10,000. However they also suffer €3,500 in write off of capital, leaving a net return of €6,500, or 6.5%. The full €10,000 is taxable, let us say at a rate of 48% + 4% Social Insurance, leaving a net liability to the State of €5,200. The net gain for the year is just €1,300 or 1.3%.

Hi Niall,

thx for the input on the situation in Ireland. Yes, whether or not losses (defaults) are allowed to be offset against interest earned is a crucial point on how good the return/risk ratio is post tax. The situation differs from country to country on this.

How come for the Netherlands the tax rate ends up being 12% ? That 10% ROI should be taxed 30%*4%, no?

Hi Mikis,

let’s calculate an example. Assume you are a Dutch resident, you invested your total wealth of 20,000 EUR in p2p lending and you earned 2,000 EUR interest in the last year. The Dutch government sends you a tax bill of 30%*4%*20,000 EUR = 240 EUR. So you earned 2,000 EUR and paid 240 EUR tax. That is an effective tax rate of 12% (240/2,000).

Except that if your total wealth is €22000 you won’t have to pay any taxes since the first €30000 are not taxed 🙂

In Luxembourg Tax rate is your normal tax rate (it is amalgamated with your other revenues). As of today losses incurred (defaults) are not deductible from your income. This means that the actual tax rate might be significantly higher if you have a lot of defaults in your portfolio

It’s interesting, never realised Lithuania could be on a lower taxed level. Has anybody considered opening up a company in Estonia for investment purposes?

Did you think that Lithuania is a high taxation country? Regarding your question: https://www.p2p-banking.com/countries/baltic-experiences-with-setting-up-a-company-in-estonia-for-the-purpose-of-investing-in-bondora-p2p-lending/

But be sure to study seat of control rules of your home country, before getting any ideas. And talk to a qualified tax advisor!

Thanks for this post. I’m trying to work out if I would need to register for foreign income tax to invest via P2P abroad (for example, via Bondora “Go and Grow”), but I can’t find the information anywhere. Any advice you have much appreciated.

Hi,

p2p investors are usually taxed in their country of residency. Therefore someone not living in Estonia investing at Bondora will pay tax where he lives and does not need to register with Estonian tax authorities. However in certain cases special circumstances could apply, therefore you should always seek guidance from a qualified tax advisor.

A very interesting read, i love to geek down in tax law for my investments to make sure i have absolutely optimized my taxes and am doing everything absolutely correct tax-wise.

A factor to consider for me as an EU citizen but in a country with a local (non-Euro) currency is that doing business (P2P-loans, stocks/bonds etc) could generate currency gains (or losses). If my local currency weakens relative to the Euro i make a currency gain on getting a repayment/interest, but if the Euro instead weakens i am instead left with a (small) loss which i usually can only deduct a minimal part of towards taxes.

Worst part however is having to calculate for currency gains on each and every P2P transaction (hundreds or thousands per year), so i am actually working on building a tool for this to actually make it administratively viable to invest in P2P for me.