P2P lending marketplace Finbee has so far offered consumer loans only. Now Finbee is extending the product range to SME loans. Finbee sources the applying companies through a separate website and will focus on small loans up to 15K EUR and a term of 12 months. For most business loans rates will be fixed without an auction (which Finbee uses to set interest rates for consumer loans). Different to consumer loans, investments into business loans will not be covered by the Finbee compensation fund (CSF), if the loan defaults. Each loan application will be individually assessed, by assigning risk grade from A+ to D, where A+ is a low risk loan, D – high risk loan, based on reputation of the management (20% of risk grade), financial sustainability (60% of risk grade), market situation (20% of risk grade).

P2P lending marketplace Finbee has so far offered consumer loans only. Now Finbee is extending the product range to SME loans. Finbee sources the applying companies through a separate website and will focus on small loans up to 15K EUR and a term of 12 months. For most business loans rates will be fixed without an auction (which Finbee uses to set interest rates for consumer loans). Different to consumer loans, investments into business loans will not be covered by the Finbee compensation fund (CSF), if the loan defaults. Each loan application will be individually assessed, by assigning risk grade from A+ to D, where A+ is a low risk loan, D – high risk loan, based on reputation of the management (20% of risk grade), financial sustainability (60% of risk grade), market situation (20% of risk grade).

Audrius Griskevicius, head of SME lending, told P2P-Banking: ‘SMEs in Lithuania have very limited access to financing. As result of this, the government issued a law, allowing p2p lenders to issue loans for small business. Finbee took an active role in development of necessary regulation and we are very proud to be the first one to receive a license of p2p lending to SMEs.’

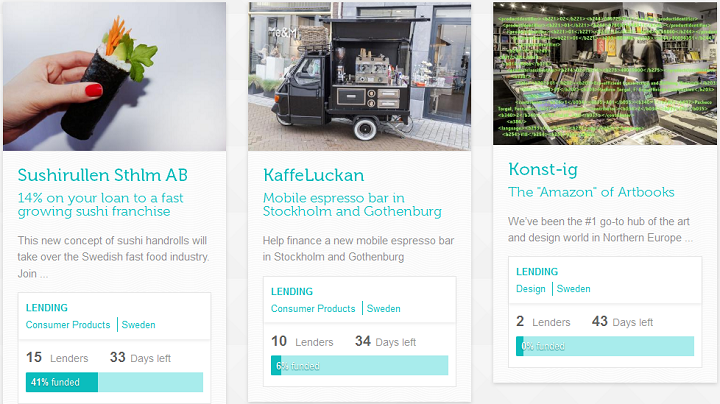

The first business loan listing is online. Magava wants to borrow 10K EUR working capital for 12 months at 15% interest rate. Investors have to complete a self assessment survey before they can invest into business loans.

What are the three main advantages for borrowers?

What are the three main advantages for borrowers?