Can you please give a short introduction on iuvo’s offering?

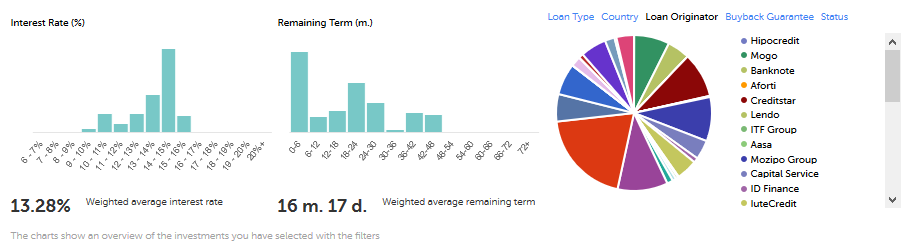

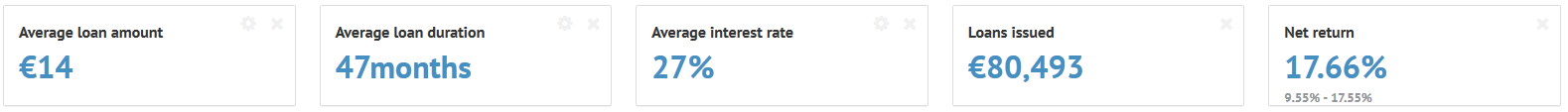

Over the past year iuvo* has been developing quite nicely, launching a new product and closing 2021 with fantastic results. A high-level overview of 2021 can be found in our blog – https://www.iuvo-group.com/de/iuvo-in-2021/. This year started strong and then the Russo-Ukrainian conflict began and changed the game for everyone. Thanks to the outstanding work done by our experienced account managers, we assured our investors in the stability of the platform and not even in a single month did we end up net negative in terms of investments on the platform. In spite of the difficult situation, we managed to onboard 5 new loan originators thus increasing the investment opportunities for our investors. They are offering a nice diversification for our investors both within the Management Financial Group (MFG) and outside. The new loan originators entered the market with high interest rates and pushed the entire market to raise their interest rates in the 9 – 12% interest rate margins. To top it all, we rebranded iuvoUP to iuvoSave – thus making it the simplified product with the highest return currently on the entire P2P market. IuvoSave is very attractive because it offers 3 different investment periods with the shortest one being 3 months and the longest – 12 months. Also in the 6 months and the 12 month product you can invest up to 1 000 000 EURO, which is also unprecedented on the market.

I understand iuvo has a new management team. Can you please introduce the team and their background?

You are absolutely correct. Iuvo always had ambitious plans and will be aiming to continue down the road of success with a new CEO, and completely new marketing and IT development strategies. Blagovest Karadzhov started as CEO in the beginning of March (you can find out more about him in our blog

Intro – https://www.iuvo-group.com/de/blagovest-karadzhov-takes-over-the-management-of-iuvo/

Interview with our CEO- https://www.iuvo-group.com/de/interview-blagovest-karadzhov-ceo-of-iuvo/ )

Our marketing strategy is aiming at drastically increasing the number of investors on the platform with different activities. It is also critical for us to increase the brand awareness of the company among the non-savvy investors. It is a tough task, but we are certain that the entire p2p ecosystem will benefit. In terms of technical development, we are aiming at some groundbreaking innovations in the P2P marketplace and we hope we will achieve them by the middle of 2023 and investors will feel them even as early as Q1 of 2023. Of course, all our endeavors are backed by MFG, part of which is iuvo.

Has the new management made any changes to the strategy of iuvo or do you continue the path as before?

Has the new management made any changes to the strategy of iuvo or do you continue the path as before?

As I mentioned we have revised our marketing and IT strategies to allow for rapid growth of the client base on the platform and to even better match investor expectations. P2P will continue to be our core business and the business model will also remain the same. Nevertheless, the needs of the investors show that they are interested in diversifying their investment options and we are considering how to offer different investment options, both within and out of the P2P sector.

Recently iuvo announced that the legal seat of the company running the platform will be moved from Estonia to Bulgaria. Can you please explain the reasons for this move.

Well, in short, the reasons are pretty trivial, financial and legislative. Back in 2016 Estonia was a fruitful ground in which we could flourish and develop and we are thankful for all the years we managed the platform under the Estonian legislation. Currently it is financially and operationally wiser to move out of Estonia so that we can continue to provide the highest quality of investment opportunities and service to our investor while raising our efficiency. Through all these years, the headquarters of MFG have been in Sofia, and as part of this group of companies, we believe it is time to come back home. This will lead to considerable cost saving which will help us reach the goals mentioned previously in our conversation. It is critical to point out that iuvo will not change the way it operates and there will be no changes in the investors’ experience, or the loan originators’ business practices as a result of this move to Bulgaria.

What’s your view on the economic outlook in Europe, especially regarding the countries your loan originators operate in?

We are onboarding companies from Spain, Romania, and North Macedonia. All these countries have a stable standing in terms of credit risk without any major deviations. Company wise, all new loan originators are ongoing a very thorough due diligence process. Just as a very basic example – even at the start, we start with an NDA and a verification if the person signing the NDA has actually the right to sign it and in the case of multiple owners, if they can sign individually or simultaneously, and we move forward only in the case when we have the right persons’ signature on the document. Only then do we move forward with the due diligence process, which usually if both teams are fully devoted and work in full speed will take on a month, while usually it takes around 3 months. Another example – with one of our loan originators, all the documents that needed to be signed in order to start the onboarding process, fitted in 5 boxes. Overall in Europe the inflation is rising and we are still to see how the governments will handle the winter and the rising inflation.

What plans are on iuvo’s roadmap for the near future?

Iuvo’s* roadmap is pretty straightforward – keeping the same business model without any changes, getting rid of all technical debts in the next 12 months, expanding in terms of loan originators and most importantly increasing the number of satisfied investors enjoying high levels of return on iuvo.

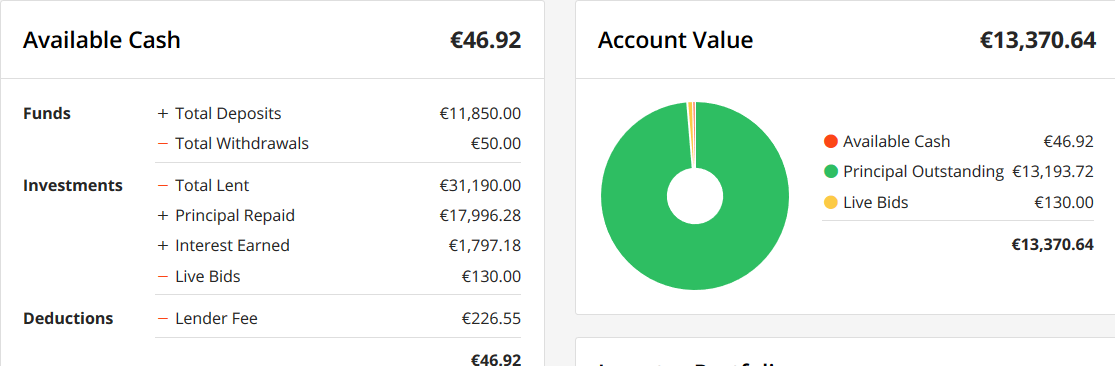

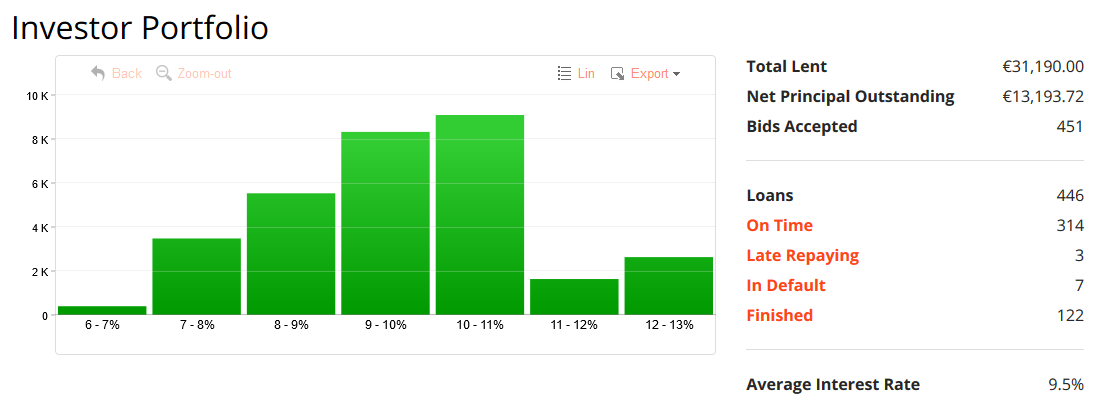

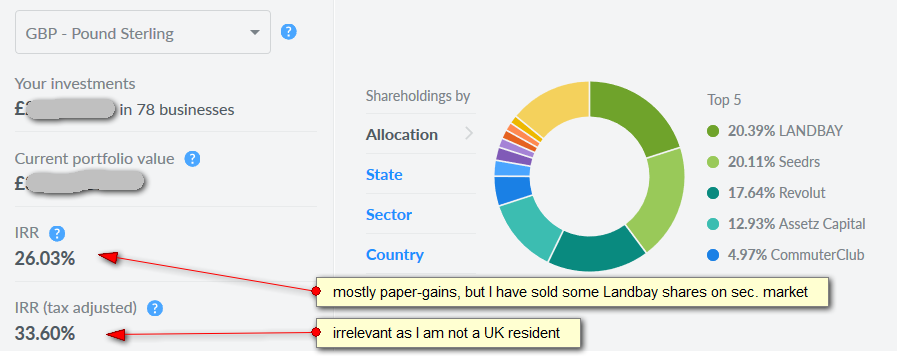

After I completely exited

After I completely exited

Is the technical platform self-developed?

Is the technical platform self-developed?