A new twist to peer-to-company lending. So far p2p lending marketplaces facilitated lending from the crowd to other companies now U-Haul has its own p2p marketplace called U-Haul Investors Club. There anybody can purchase collateralized debt security notes issued by Amerco (the parent company of U-Haul). The minimum deposit required to start investing is 100 US$.

The loans are backed by collateral. Typical interest rates range from 3 to 7%. In the time since the opening of the U-Haul Investors Club in February 2011 approx. 7 million US$ in equipment financing was raised.

(via SocialLending.net – read more in Peter’s article here).

The initiative is called

The initiative is called  German p2p lending service

German p2p lending service  It is a successful autumn for French p2p lending service

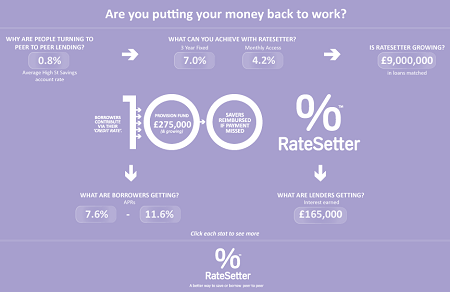

It is a successful autumn for French p2p lending service  In England p2p lending service

In England p2p lending service