![]() Prosper.com has restarted offering p2p lending to customers after an SEC imposed 6 months stop (quiet period).

Prosper.com has restarted offering p2p lending to customers after an SEC imposed 6 months stop (quiet period).

Prosper chief executive Chris Larsen said the California Department of Corporations has authorized the company to resume raising money in California and then lending it out under a system that lets borrowers and lenders use bids to set the interest rates on loans. “I hope this leads to wider acceptance of peer-to-peer lending,” said Commissioner of Corporations Preston DuFauchard. He said the state’s experience with Prosper, prior to the SEC intervention, made it “comfortable” that its bidding system gives lenders the information they need to invest in loans wisely.

Prosper hopes to reopen for lenders from other states but it remains uncertain when Prosper will be allowed to do so.

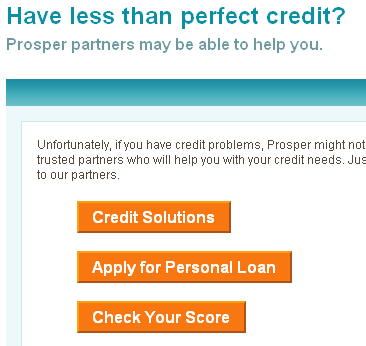

Prosper raises the minimum credit score required to 640 (Grade C under the old rating). This applies only to new borrowers. Borrowers registered before the quiet period that have lower credit grades can still apply for second loans (example: loan listing of a HR borrower).

Besides “direct” p2p loan listings, Prosper offers “Open Market Listings“, which are described as following:

Open Market loans are existing loans that were underwritten by financial institutions that are credit experts in areas such as auto loans, small business loans or social impact loans. The loan seller describes the loan in an Open Market listing, and then sells and assigns the loan to Prosper.

Open Market loans may include existing consumer loans or retail installment sale contracts. They can be secured or unsecured loans, and may include small business loans, where the borrower is a business entity, not an individual.

Open Market listings describe the existing Open Market loan, owned by the loan seller, which is offered for sale on the Prosper marketplace. Each listing displays information to assist the lender in making an informed bidding decision. Lenders can review the sale price for the Open Market loan, the yield percentage that corresponds to the sales price, the remaining principal balance of the loan and the interest rate the borrower is obligated to pay on the loan.

In some instances on auto loans, you can even see the factory where the car was built. This is all part of the transparency Prosper brings to the marketplace so that you can make informed decisions on how to invest your money.

Prosper plans a secondary market which in future will allow lenders to trade notes.

(Sources: Prosper, San Francisco Chronicle)

Asked by

Asked by