It's been roughly 3 month since the launch of German p2p lending service Smava.de and I want to do a short résumé on the results so far. One huge achievement is that all borrowers made their first payment on time – no lates so far. While it certainly is to early for conclusions, since only one payment cycle (first repayment in the beginning of June) has taken place, the outlook for Smava concerning low default rates is very good. Looks like Smava will be much nearer to Zopa then to Prosper in this point.

Smava has a very restrictive approach for admitting borrowers and loan applications. Not only does Smava verify identity, credit score and income documentation – it goes one step further and calculates if the borrower's financial situation is well enough to allow repayment of the desired loan sum. Only after completions of all these checks is the borrower allowed to publish is loan listing.

As a result the majority of borrowers (about 70 to 80 percent of all applicants) are declined from using Smava. While this strict validation is good for quality it does slow the growth of Smava.

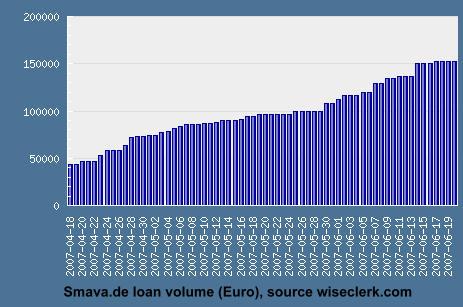

Since the launch Smava enjoyed large and positive press coverage (newspapers, magazines, TV, internet). Despite the good PR, Smava funded only about 50 loans with a loan volume of about 150000 Euro in the first 3 month. There are enough lenders – Smava lacks borrowers. The low volume contrasts sharply from the figures Boober.nl achieved in the Dutch market (see previous post)

The majority of loan listings that were published did get funded. Smava has two interesting functions that are unique and not used on other p2p lending services:

- Borrowers can close the loan early provided it is more than 50% funded

At Smava, listings usually run 14 days. However a borrower can decide to take the funded amount (provided it is at least 50% of the total amount) and close the listing early. Several borrowers have used this function. A borrower can open another listing (provided he has not reached his personal maximum repayment allowance) instantly for the remainder (he can even choose a different interest rate for subsequent listings) - Borrowers can increase the offered interest rates on their open listing. If this happens the change is applied for all bids on this listing. This is a widely used feature. Many borrowers start with (ridciously) low rates. After a few days they realise their loan will not fund and they increase their interest rate – often in several steps

Smava has yet to find a good concept for groups. While there are groups their purpose is yet to be defined. Consequently the majority of borrowers did not bother to join a group.

I will continue post updates on the development of Smava here on P2P-Banking.com.