![]() P2P lending marketplace Bondora announced that it will pull the primary marketplace from the user interface effective November 1st. This removes the chance for investors to manually invest on selected loans, leaving the options to either use the automated portfolio manager or to use the API.

P2P lending marketplace Bondora announced that it will pull the primary marketplace from the user interface effective November 1st. This removes the chance for investors to manually invest on selected loans, leaving the options to either use the automated portfolio manager or to use the API.

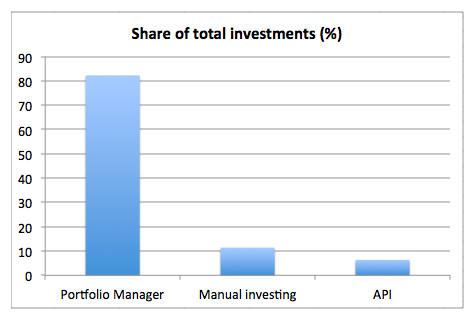

Earlier this week Bondora provided this statistic showing that the majority of investments is done through the portfolio manager. This is another of the many changes the Bondora marketplace underwent in the past years.

The announcement email sent today, reads:

On November 1, 2016 we will remove the Primary Market view from the user interface.

What does this mean?

In recent months it has become clear that the Portfolio Manager offers greater efficiency through automation compared to manually investing. The increasing benefits of Portfolio Manager are the result of recent updates to the funding process, which optimize speed. Moving forward we will continue to focus efforts on further improving Portfolio Manager, Bondora API, Secondary Market and the reporting features available on the platform.

Why is Bondora removing the Primary Market from the user interface?

Bondora is removing the Primary Market from the UI because the speed of our popular automated option meets the investing and borrowing needs before manual investing can take effect. Our process improvements have created an environment where almost all loans are funded before they become visible in the UI. As a result, the Primary Market is most of the time empty.

This scarcity is due to the fact that when a loan enters the market it is open to bids for 10 minutes. After the 10 minutes expire the loan is closed. Our internal analysis and reporting shows that almost 100% of loans are funded within this brief window of time. Therefore, there is little reason to hold loans open any longer, as doing so would create unnecessary delays.

What should API users do?

Removing the primary market from the user interface does not change anything for Bondora API users. However, API users should review their settings for polling loans from primary market and reconfigure their settings to match the changes to the current funding process. We recommend that the polling of new loans be set to once a minute. Our API allows for speeds up to one query per second, however such rapid polling is also not recommended.