I read a lot. Really a lot. I average about 100 to 150 books I read each year. Nevertheless I rarely blog about a book on this blog, since I want to keep this blog focussed on the topic.

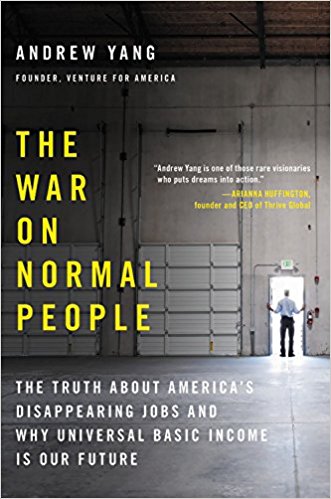

I’ll make an exception today. For one of the best books written by a politican I ever did read.

It does not offer a vision. It is better. It is a profound, through analysis of the current state of society, the upcoming huge challenges we face, the likely consequences of these and a set of solutions that actually are logical, made sense to me and are financially feasible.

Most politicians seem to be doctoring with tiny steps on the symptoms, but in this book the author describes a clear path he would want to take forward.

The book is written by Andrew Young, running for US president in 2020. I have no idea what his chances are. And I actually do not care much about inner-American politics.

The point is: In my view this book is not (only) about America. It addresses the major questions most Western society will face in the next decade. In Europe the impact will be delayed a few years and softened by better social security systems, but many aspects are the same.

The point is: In my view this book is not (only) about America. It addresses the major questions most Western society will face in the next decade. In Europe the impact will be delayed a few years and softened by better social security systems, but many aspects are the same.

One of these challenges is the replacement of many, many jobs by algorithms (AI) or robots (did you watch ‘Humans need not Apply’?).

What does it mean for all of us if millions of job disappear in a very short time-frame?

As part of the answer he proposes Universal Basic Income (UBI). I have been very sceptical about UBI. It reminds me too much about the failed Eastern European economies of the last century. And I am still not convinced. But Yang lays out a very logical set of arguments that makes me more curious.

Rarely have I wanted so much to see the implementation of a political plan, to see if it works out and delivers the expected results. A lot would have to happen. It is one thing to lay it all out beautiful in a book and a totally different beast to win the majority to implement change.

The book gets rave reviews on Amazon.com and in my view they are well deserved. If you are looking for a really interesting book either to read yourself or as a gift, I highly recommend:

‘The war on normal people’. The book is available at Amazon.com*, Amazon.co.uk*, and Amazon.de*.

The title is the least fitting part of this book.