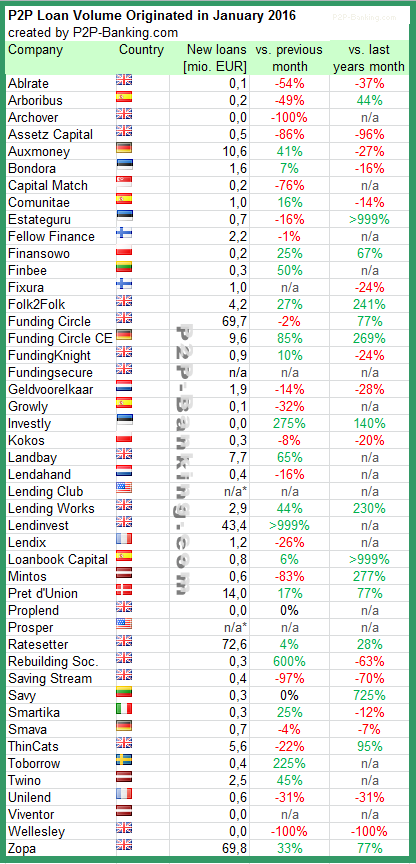

The following table lists the loan originations for January. This month Ratesetter led, followed by Zopa and Funding Circle. I added one more marketplace to the list. I do monitor development of p2p lending statistics for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Investors living in markets with no or limited choice of local p2p lending services can check this list of marketplaces open to international investors. Investors can also learn how to make use of p2p lending cashback offers available.

Last month these companies crossed significant milestones:

- Ratesetter reached 1,000 million GBP in loan originations since launch

- Lendinvest has lent 500 million GBP since launch

- Bondora has issued 50 million EUR since launch

Table: P2P Lending Volumes in January 2016. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

Notice to p2p lending services not listed:

For companies first listed after January, 4th 2016 a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

For companies first listed after January, 4th 2016 a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

Are you sure mintos number is correct? Mintos stats show different numbers https://www.mintos.com/en/statistics/

Mintos’s volume is so low compared to the volume on their homepage. ???

Hi James, hi Yacop,

I now checked with Mintos. They changed the way their statistics page is compiled sometime in January. This led to the confusion. The figure for January Mintos reports is 2.9M EUR.

Please contact me by e-mail!

Thanks

Woutr

Comment regarding loan volume Funding Circle Continental Europe:

We made a slight mistake regarding January volume. Correct number is 7,8 mio euro.

Best,

Lerato Bogatsu

Head of Communications FC CE

Hello, Claus!

Do you know what is happening at Auxmoney? They originated close to EUR 40mln monthly in the late 2015, and now their volumes are lower than of Pret D’Union. Could it be a short-term influx of Aegon money?

Thanks!

Jevgenijs

Hi Jevgenijs,

no, I don’t know what is causing the drop. I don’t think funding money is short. More probable something on the loan demand side, e.g. marketing, changed.